Recent reporting in the Kenyan media points to a disturbing trend in the nascent mining industry. Kenya has repeatedly been ranked at the bottom of the list of attractive destinations to invest in mining ventures by The Frasier Institute and if recent reporting is anything to go by, this trend is not improving but worsening.

Alleged political interference and intimidation in the counties is a new and potentially lethal addition to the mix. We highlight the cases of Karebe Gold Mining in Nandi County and Tata Magadi in Kajiado where county governments are causing problems for large investors in the sector:

KAREBE GOLD MINING

Despite paying billions in royalties and operating a popular and well funded CSR, Karebe Gold Mining finds itself the target of the Nandi County administration.

MEDIA MAX NETWORK – http://www.mediamaxnetwork.co.ke/390092/gold-miner-appeals-state-protection/

If these allegations are true, and the evidence certainly point this way, then Governor Sang and his administration are not doing his county or its people any favours. Karebe provides jobs, opportunity and an excellent, popular CSR program. It also pays huge taxes and royalties to the Treasury.

This sort of politically motivated harassment belongs in Kenya’s past, not its future.

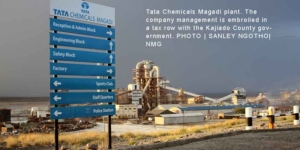

TATA MAGADI

Unreasonable and unrealistic arbitrary land rate hikes in Kajiado county threaten to shut down the operations of one of Kenya’s oldest mining investors, Tata Magadi:

When counties implement policies which have the effect of disrupting legally operating businesses in a destructive and unreasonable manner, the entire country loses.

INEFFICIENT TAX REGIME CAUSE FRUSTRATION AND OPERATING CAPITAL ISSUES FOR LARGE INVESTORS IN THE MINING SECTOR

Mining is a capital intensive sector and profits often are not realized for many years in some larger operations. Hence, a tax regime which stifles operating capital is anathema to investors in this sector.

The recent case of the largest mining investor in Kenya, Base Titanium serves to highlight the ongoing frustrations of an inefficient tax regime in Kenya. KRA owes over 2.4 billion in VAT refunds to the Australian investor :

As most operators in the sector are exporters, the ongoing issue of KRA VAT refunds is one that affects the entire industry.

The Mining Sector has the potential to transform lives and communities at the grassroots level like very few other sectors. Large investors like Karebe, Tata and Base Titanium who invest heavily, employ widely, pay huge remittances to the state coffers and operate transformative CRS programs in their local communites need to be supported not harassed and frustrated.

If President Kenyatta’s Big 4 Agenda is to have any success, much will depend on the investment and operational climate for businesses who fund the state with their taxes.